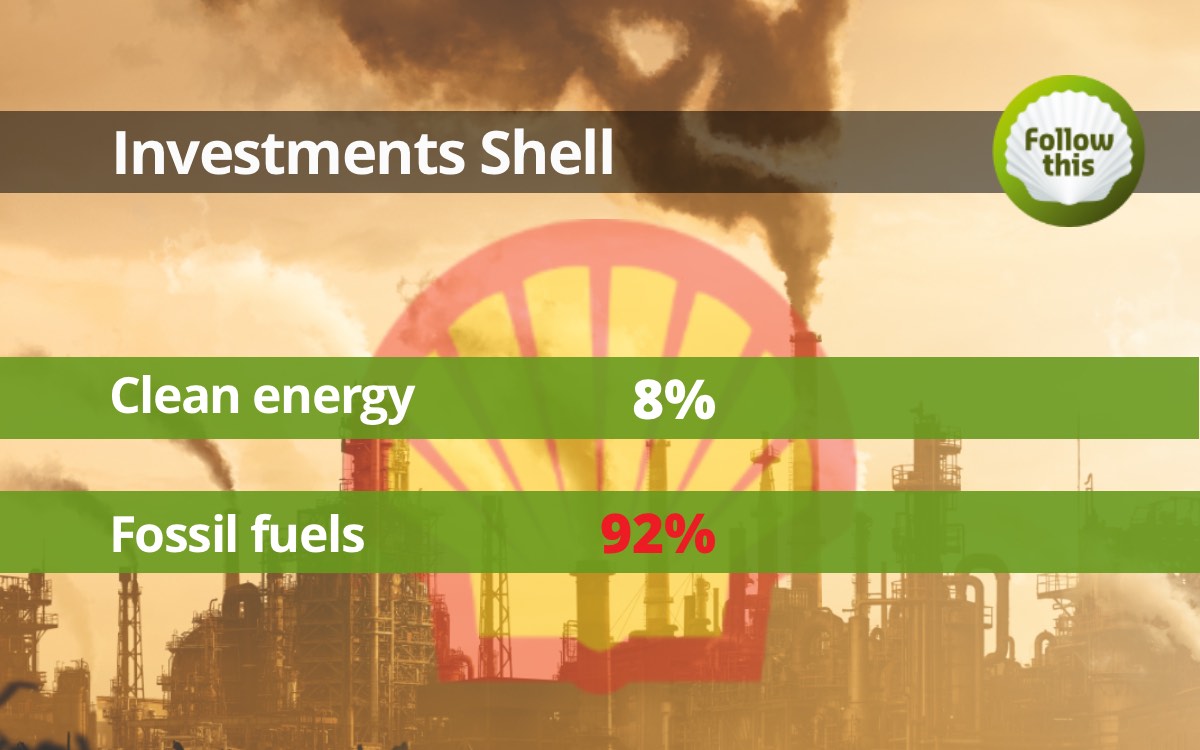

Shell’s latest financial report reveals a concerning trend: investments in renewable energy have fallen to a mere 8% of the company’s total spending. Shell is still heavily investing in fossil fuels despite the growing need for clean energy.

“By continuing to bet on fossil fuel expansion, the board of Shell jeopardizes the future of the company,” says Mark van Baal, founder of the activist shareholder group Follow This.

Fossil fuel growth delays the transition and increases the risk of a carbon lock-in, a situation where we get stuck with high-carbon energy systems and infrastructure, making it difficult to transition to cleaner alternatives.

Van Baal: “Shell’s investments in fossil fuels are in collision course with the Paris Climate Agreement that requires almost halving emissions by 2030. Investors who are committed to Paris must change the mind of the board of Shell, which is one of the highest emitters. Big Oil can make or break the Paris Accord. Shell could lead and thrive in the energy transition.”

Captivated by high oil price

“Shell is increasing reliance on fossil fuels because the board is captivated by current profits from high oil and gas prices,” says Van Baal. “However, the handsome carbon-based business model will be over as soon as fossil fuel companies must pay for climate damage. Instead, Shell should use the current profits to explore new business models – instead of more oil and gas. Shell’s attitude shows a lack of imagination beyond oil and gas, and failure to understand the concepts of disruptive innovation and stranded assets.”

Share buybacks

Shell also announced to continue its share buyback program. “Share buybacks reveal a lack of imagination beyond oil and gas. A company that buys back shares is effectively saying to investors: we know of no better use for this money than to return it to you”, Van Baal says.

Baby steps

“Seven years after Shell bowed to shareholder pressure by announcing to embark on the energy transition, CEO Wael Sawan undoes the baby steps his predecessor Ben van Beurden took,” Van Baal says.