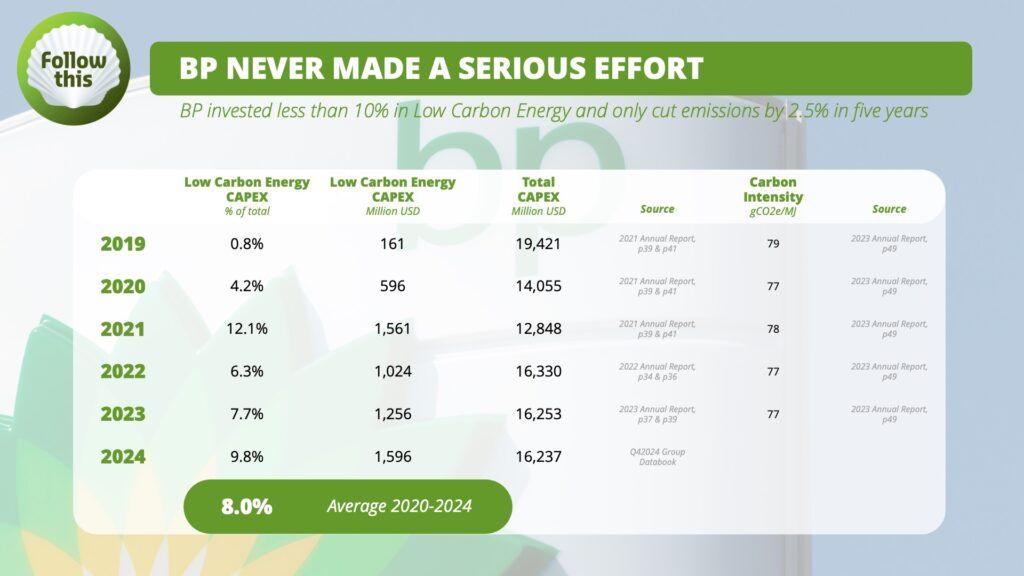

Oil major invested less than 10% in Low carbon energy and cut emissions by a mere 2.5% in the last five years

PRESS RESPONSE to BP’s capital markets’ day, February 26

After 5 years of pretending to transition to renewable energy, BP increases investments in oil and gas and scraps (‘retires’) all previous aims and targets, the oil major announced today in a press release.

“With less than 10% of investments in Low carbon energy* since 2020, it’s clear BP never made a serious effort to transition,” responds Mark van Baal of Follow This, a long-term activist shareholder. “The previous CEO Bernard Looney was an excellent salesman of green promises, but BP never walked the talk.” *BP’s‘ Strategic pillar’ called ‘Low carbon energy’ includes Renewables & power and Hydrogen (table below).

In 2020, Follow This withdrew its climate resolution after CEO Bernard Looney promised to embark on the energy transition, Follow This and BP announced in a joint press release.

“You cannot conclude BP failed in renewables when the vast majority of its investments was in fossil fuels, and emissions hardly declined,” he adds. Since 2019, BP’s carbon intensity has dropped just 2.5%, from 79 to 77 gCO2e/MJ (table below).

Setback, Shareholders hold the key

“This is another setback in the fight against the climate crisis. We hope investors in Big Oil realize that they hold the key to tackling the climate crisis by steering oil companies in the right direction.”

Future of BP at risk

“The board is endangering BP’s future by ignoring the energy transition and increasing investments in potential stranded assets.” The International Energy Agency (IEA) forecasts a decline in oil and gas demand after 2029.

“Even shareholders who don’t care about climate risk, should be worried. BP risks a dramatic decline in share value as the market adjusts to the realities of disruptive innovation, stranded assets, and climate liabilities. Sooner or later oil companies will be held liable for the costs for climate damage.”

“The company’s half-hearted investments in clean energy have failed to generate new business models, while its traditional fossil fuel operations underperform.”

Investor support—reaching up to 20% of votes—for Follow This climate resolutions pushed BP to set emissions reduction targets. However, Van Baal highlights BP’s reluctance to embrace real change:

“BP wanted to remain an oil giant yet not look like one. Mixed signals from the board have confused both shareholders and employees. BP’s predicament stems from the contradiction between its public messaging and operational reality.”

Short-term activists ignore climate risks

Elliott Management, known for its short-term activist investment strategy, has a track record of pushing for overhauls, boardroom changes, or company breakups.

“Elliott’s agenda is most certainly not focused on the long-term future of BP,” says Van Baal. “Short-term activists ignore risks such as peak oil and gas, stranded assets, carbon taxation, liability for climate-related damages, and disruptive innovation.”

Van Baal suggests that Elliott’s intervention could prompt BP to acknowledge the value of long-term activist investors, such as Follow This and the one-fifth of shareholders who vote in favor of climate-focused resolutions.

“Now that BP is under pressure from a short-term activist, they might finally recognize the significance of long-term investors pushing for real emissions reduction targets and long-term value creation.”

Murray Auchincloss Faces the Legacy of Bernard Looney

BP’s lack of strategic clarity is a consequence of the contradictions under its former CEO, Bernard Looney. While Looney publicly committed to radical change—announcing a 40% reduction in oil production—he continued managing the business as usual. His tenure saw BP halving dividend in August 2020 and the company’s exit from Rosneft in February 2022, which accounted for nearly a third of BP’s oil production.

Looney’s successor, Murray Auchincloss, a former CFO without an engineering background, now faces the challenge of navigating this legacy.

A ‘Paris-Flexible,’ Not ‘Paris-Aligned’ Strategy

“Despite presenting itself as a leader in the energy transition, BP failed to set clear targets for total emissions reductions by 2030. Looney’s approach was characterized by a plethora of aims. Looney wanted to transform BP into an asset light company.”

Follow This coined his strategy “Paris-flexible” rather than Paris-aligned.

“Looney hedged his bets on two possibilities—either the world would meet the Paris goals, or it would fail to do so.”

“Auchincloss clearly bets on the failure of Paris, that requires almost halving emissions this decade.”